Gabriel Black

The bottom 40 percent of households in the United States have an average net pre-tax income of negative $11,660 a year, according to a new report by Reuters.

The report, “Poorer Americans Buckling as US Economy Booms,” published July 23 and written by lead author Jonathan Spicer, exposes how life really is for most Americans in the midst of the supposedly booming economy. While the official unemployment rate is low and growth rates are rising, the reality is that the working class is stretched to its limit, relying heavily on borrowing and working two or more low-wage jobs to survive.

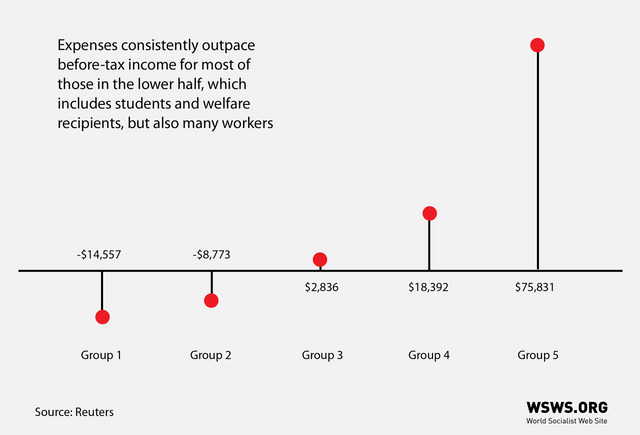

The report’s data shows that the bottom two quintiles of households make, on average, $11,587 and $29,414 a year in pre-tax income, respectively. Their expenses, meanwhile, are $26,144 and $38,187, respectively. This means that the bottom quintile has an average net loss of $14,557 a year and the next quintile a loss of $8,773, prior to taxes.

How is it that the bottom 40 percent of households are losing, on average, well over $10,000 every year?

The data covers students, who are taking on student debt, and recipients of food stamps and federal benefits, who may receive small sums to help pay for expenses. However, the bottom 40 percent of households is overwhelmingly composed of low-wage workers, who, despite their immense sacrifices, are unable to cover the basic cost of living.

The next 20 percent, the middle quintile of the country, is not faring well, either. With an average pre-tax income of $51,379, it is able to achieve a net income of only $2,836 before taxes. A family making $50,000 a year in 2017 would have to pay $3,448 in federal income tax, plus state and FICA taxes. This means that even the middle 20 percent of the population is unable to save money and is, on average, taking on some form of debt.

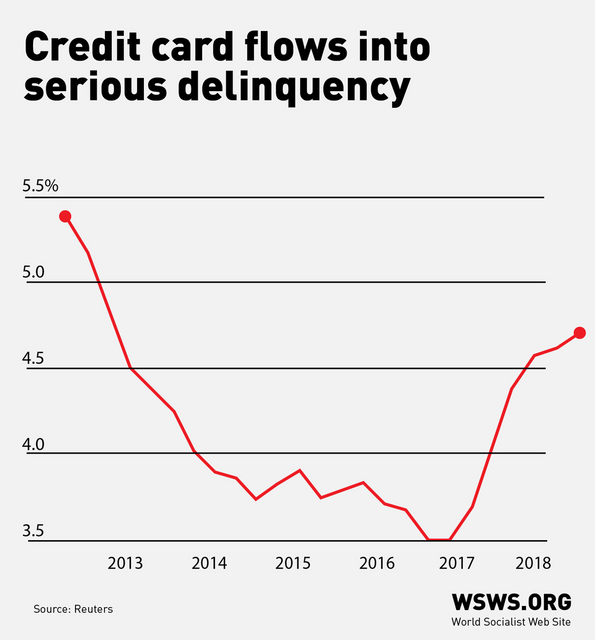

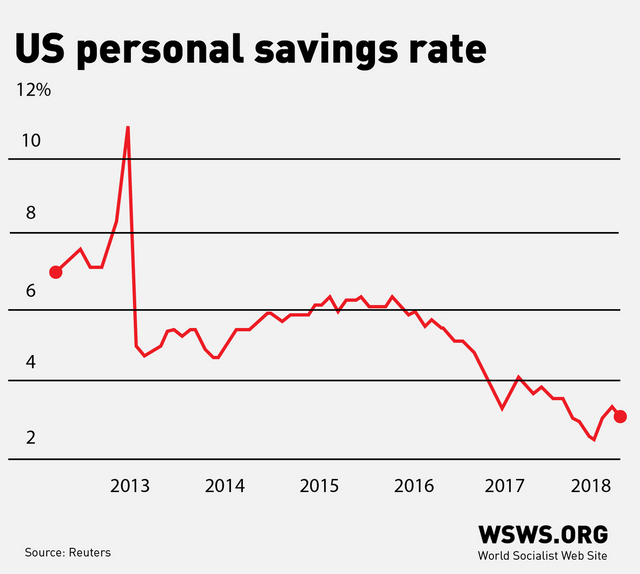

This growing burden of debt on the bottom 60 percent of the population is expressed in the sharp drop in the US personal savings rate over the past three years, declining from 6 percent in 2015 to between 2.5 and 3 percent in the past few months. Likewise, the rate of credit cards becoming seriously delinquent rose from 3.5 percent in 2016 to 4.7 percent in March 2018. Subprime auto loan delinquencies are now higher than what they were at the height of the financial crisis.

This data from Reuters exposes the real character of the post-2008 “economic recovery.” It is a recovery for the rich at the expense of the living standards of the majority of working people. While the stock market has surged to astronomical heights, and the wealth of the millionaires and billionaires has surged alongside it, the majority of the American people are substantially worse off than they were prior to the financial crisis.

This is no accident.

The post-2008 recovery, led first by Barack Obama and now overseen by Donald Trump, was based on slashing the wages and living standards of the working class to extract more profit for the capitalists. Starting with the autoworkers and spreading to every major section of workers in the country, employers demanded “sacrifices” that they, and the unions, promised would be made up after the recovery.

The “recovery,” however, has arrived, and none of the sacrifices workers made are being paid back. Instead, it is the ultra-rich that are cashing in. This year will see a record level of share buybacks and divided payments, exceeding $1 trillion. These parasitic financial measures, which take money out of investment in new jobs, research and infrastructure, allow people like Safra Catz, CEO of Oracle, to pocket $250 million in a single year.

Data from Reuters shows that while the bottom 60 percent of the population generally saw its expenses outpace its income between 2012 and 2017, the income of the top 20 percent increasingly outpaced its expenses over this same period. On average, the top 20 percent of the population makes $188,676 and spends $112,846. This layer makes more money than all of the other income quintiles combined.

The amount the top 20 percent of the population is able to save each year ($75,831) is more than six times the average income of the bottom quintile and more than two-and-a-half times the income of the next quintile. Within the top 20 percent, there is immense social differentiation, its low end composed of workers in decent-paying professions and its high end composed of millionaires and billionaires.

The report notes that the surge in debt and general economic precariousness of the bottom half of the population threaten to trigger a new financial crisis. The authors write: “As many of the most vulnerable workers sink deeper into the red, the nearly decade-long economic expansion may be more vulnerable to a further spike in gasoline prices or an escalation of trade conflicts.”

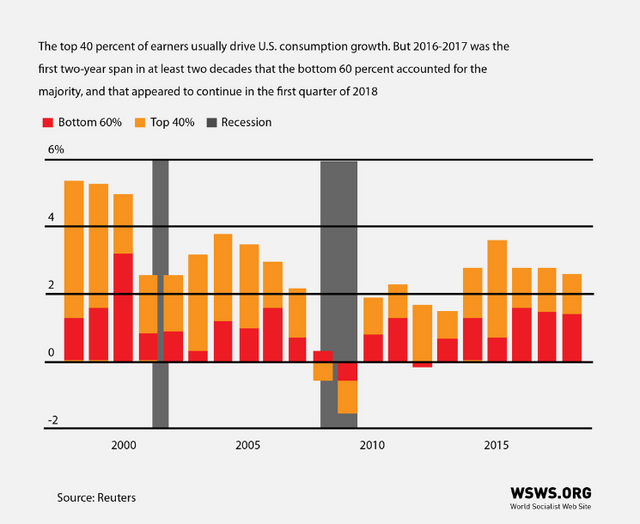

The authors call attention to how, historically, US consumption growth is dominated by the top 40 percent of earners. However, in the past few years, the bottom 60 percent of earners has accounted for the majority of consumption as it ran down its savings. Consumption makes up for over 70 percent of all economic activity in the United States and plays a critical role in economic growth.

In the past few years, the United States has been wracked by opioid addiction, increasing suicide rates and declining life expectancy. The fundamental cause of this immense and growing social crisis is the impoverishment of the working class, the broad mass of the people.

President Trump’s Council of Economic Advisers states that the war on poverty is “largely over.” This is obviously a lie.

The Trump administration and before it the Obama administration have been fighting a war. But, it is not against poverty. They have been fighting a class war to impoverish the working population in order to further enrich the financial oligarchy that they represent.

The working class, however, is ready for a counter-offensive. Heralded by the teachers’ strikes earlier this year in West Virginia, Oklahoma and Arizona, workers are prepared to enter into struggle to take back the wealth they have created and gain control of their workplaces.

No comments:

Post a Comment