Patrick Martin

Apple, Inc. announced Tuesday that it would convert much of its overseas profits, held in a huge cash hoard for several years, into a $102 billion windfall for corporate executives and other shareholders. The financial bonanza for a single company is comparable to the GDP of Ecuador or Sri Lanka.

The maker of the iPhone, the Mac personal computer and other consumer electronics is raising its quarterly dividend by 16 percent, from 63 cents a share to 73 cents a share, a move that will provide $2 billion in increased income directly to owners of the company’s stock. Apple will become the largest payer of dividends in corporate America, surpassing ExxonMobil.

As princely as this payout is, it is dwarfed by the $100 billion buyback of Apple stock, to be carried out over the course of the year. Its effect will be to boost the company’s share price indirectly. Moreover, by reducing the number of Apple shares in circulation, it will dramatically increase such financial indicators as earnings per share, the principal measure by which Wall Street judges a company and which corporate boards use to set executive pay levels.

The $100 billion figure is not so much a record as it is another dimension in corporate plunder. With that sum, Apple could have bought every share of stock in UPS, Lockheed Martin, Goldman Sachs or Boeing. It is greater than the market value of 460 of the Fortune 500 largest US companies.

The funneling of $102 billion from Apple to its shareholders is a distribution of wealth within the ruling elite. The top five individual shareholders are all Apple executives, including CEO Tim Cook. The top three institutional shareholders, holding nearly 18 percent of the stock, are Vanguard, Black Rock and State Street, three giant investment funds. These and others like them will reap the bulk of the financial plunder from the dividend payout and buyback.

The bonanza for the super-rich is the product of two interrelated processes. First is the sweatshop labor of millions of workers in Asia, mainly China, who manufacture components and assemble the iPhones, laptops and watches Apple sells. Second is the tax cut pushed through last December by the Trump administration and the Republican Congress, with only token opposition from the Democrats.

Apple reaps superprofits from the labor of cruelly exploited workers in Asia, most of them employed through subcontractors, as well as through monopoly rents generated by its control of intellectual property rights to the underlying technology. As the WSWS has written elsewhere, “It has been estimated that the cost of an iPhone, retailing for around $650 to $700, is made up of $220 for the components and $5 for the labor of assembly.”

This accounts for the cash hoard accumulated abroad, and deliberately held there in a tax avoidance scheme, while the company’s paid lobbyists obtained the support of both Democratic and Republican lawmakers to back a “one-time” cut in the tax rate to induce American companies to return these funds to the United States.

Such a measure was initially proposed by Obama and backed by congressional Democrats, but it was not finally adopted until it could be incorporated into the broader tax cut for corporations and the wealthy proposed by Trump and congressional Republicans.

The resulting tax cut legislation slashed the basic corporate tax rate from 35 percent to 21 percent, the largest single business tax cut in US history. Apple was already paying an effective rate of only 26 percent on its current US earnings, because of various financial manipulations and tax breaks.

By far the biggest benefit for Apple came from the provision allowing global companies to bring home profits held overseas and pay a one-time low rate of only 15.5 percent, less than half the statutory rate of 35 percent. Apple had the largest single stockpile of such profits, a staggering $257 billion, accumulated in part from global sales and in part from bookkeeping transactions that artificially diverted profits to overseas accounts to escape US taxation, pending the passage of such a bill.

As part of the repatriation of this cash hoard, the company will pay $38 billion in taxes to the Treasury—an amount that will no doubt be hailed as the largest single corporate tax payment in history—but this represents a saving of $47 billion over what Apple would actually have paid if US tax laws had been enforced instead of being treated as a dead letter by giant corporations.

Trump’s Tax Cut and Jobs Act of 2017 would have been better named the “Amnesty for Corporate Tax Cheats Act,” or perhaps the “An Act to Give Apple $47 Billion While Starving Schools and the Poor.”

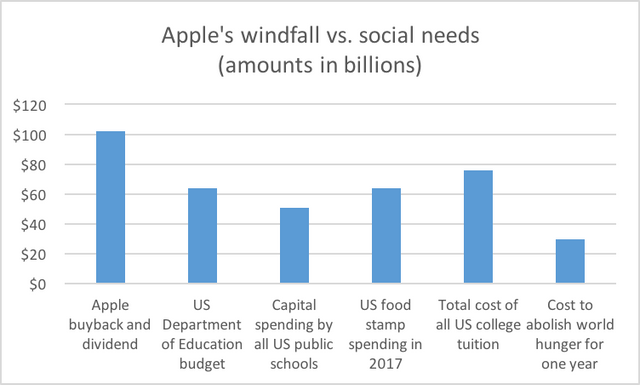

In a democratically organized and rationally planned society, much better use would have been found for the $102 billion being used to enrich those already wealthy. As the chart suggests, Apple’s $102 billion windfall could have paid for the entire budget of the federal Department of Education, or paid the full tuition cost for every US college student, with $20 billion left over. It is double what all US public schools spend on capital improvements (buildings, playgrounds, school buses, equipment) and nearly twice as much money as the federal government spends on food stamps for more than 40 million low-income families. It is more than three times what the United Nations estimates is needed to feed every hungry family in the world for the next year.

When the tax cut bill was passed last December, the White House began hyping a series of announcements by major companies of plans to raise wages, hire more workers, or invest in new facilities, in order to provide “evidence” for its phony claims that the legislation was aimed at benefiting American workers.

Apple, for example, has pledged to hire another 20,000 workers over the next five years, at a cost of $5 billion ($50,000 a year per worker, counting wages and benefits, below the median wage in the United States). Even if this $5 billion materializes, it would represent only 2 percent of Apple’s total repatriated funds. It is dwarfed by the $102 billion handout to shareholders.

In the past week, at least one prominent Republican, Senator Marco Rubio of Florida, has publicly admitted that the tax bill was sold under false pretenses. In an interview with British magazine The Economist , Rubio said, “There is still a lot of thinking on the right that if big corporations are happy, they’re going to take the money they’re saving and reinvest it in American workers … In fact, they bought back shares, a few gave out bonuses; there’s no evidence whatsoever that money’s been massively poured back into the American worker.”

Surveys by business groups have confirmed that the lion’s share of the tax cut gains will go the stock buybacks and dividends, while wage gains are estimated at 15 percent (which includes, of course, bonuses and salary increases for executives, as opposed to options and other stock-related compensation) to as low as 6 percent of the total.

Wall Street analysts now estimate that stock buybacks and dividend increases will top $1 trillion in 2018, nearly doubling the previous record set in 2007, the year before the financial crash. In the first quarter alone, stock buybacks and cash takeovers topped $305 billion, before Tuesday’s $102 billion declaration by Apple.

As for working people, nearly half own no stock at all, and the rest have minimal amounts in 401(k) retirement accounts and pensions. The bottom 80 percent of the population—the entire working class and sections of the middle class—own just 8 percent of stocks. The richest 10 percent of Americans own 80 percent of all shares.

Such figures only demonstrate the complete irrationality and bankruptcy of the profit system. The historical task of the working class is to organize itself as an independent political force, representing the vast majority of the human race, put an end to capitalism, and establish a planned socialist society under the democratic control of the workers.