Evan Blake

Within weeks, the reopening of schools across the United States has already become a complete catastrophe. Outside of the mobilization of educators, parents and the broader working class to halt this homicidal policy, there will be rapid acceleration of the spread of the deadly COVID-19 disease throughout every region of the country.

Because no government agency at the local, state or federal level is systematically tracking work-related COVID-19 cases and deaths, Kansas teacher Alisha Morris took it upon herself to begin compiling this data in a spreadsheet. The list, which is now curated by roughly 35 people, has been shared in the dozens of Facebook groups that have been set up to oppose the unsafe reopening of schools and has been viewed tens of thousands of times by educators, parents and students.

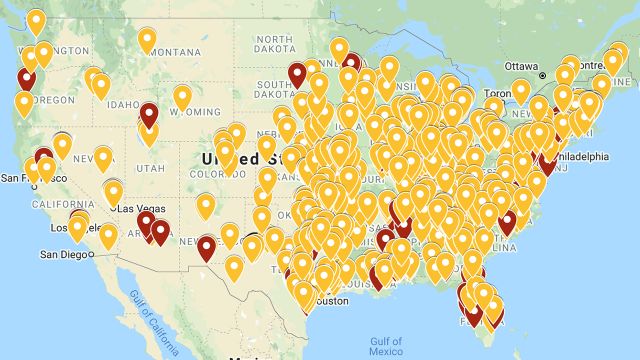

The spreadsheet, which the WSWS utilized to produce a map that has also gone viral, paints a chilling picture of the spread of the pandemic in schools across the US.

According to this data and an official account from Mississippi released Monday, since schools began reopening during the week of July 27, roughly 3,000 teachers, students and staff have tested positive for COVID-19 from hundreds of schools across the country. All but six states—Alaska, Washington, Delaware, Vermont, North Dakota, and New Hampshire—have at least one school that has already experienced an outbreak of COVID-19.

Map of over hundreds of reported COVID outbreaks in US schools

Map of over hundreds of reported COVID outbreaks in US schools

As of Tuesday, there are over 900 entries on the spreadsheet, with each one representing a separate school that has had at least one positive or suspected case since the start of the pandemic. Most entries are based on local news reports since the beginning of August.

The devastation has been most extreme in the South, which for weeks has been a major epicenter of the pandemic in the US. Largely controlled by the Republican Party, these states most closely followed the “herd immunity” strategy of letting the virus rip through the population, as advanced by the Trump administration. These officials were the most aggressive and earliest to reopen their economies and have now been the most strident in demanding full in-person instruction, often with the bare minimum of personal protective equipment (PPE) provided to teachers and staff.

The heaviest-hit Republican-led states include:

- Mississippi, where 71 of the state’s 82 counties have reported outbreaks of COVID-19 in schools. As of Tuesday, 199 students and 245 teachers have tested positive statewide, while 2,035 students and 589 teachers have been forced into two-week quarantines.

- Florida, where at least 331 students and staff have tested positive for COVID-19 and at least 11 have died, many from earlier in the summer.

- In Georgia, there are now at least 296 known cases and 481 suspected cases at 67 different schools.

- In Texas, at least 140 different schools have reported a combined 380 cases.

- Indiana now has over 100 confirmed cases from at least 75 different schools.

- Tennessee now has at least 99 confirmed cases from 44 different schools.

In total, at least 406,109 children have now tested positive for COVID-19 in the US, representing 9.1 percent of all cases. One of the chief lies used by state officials to justify reopening schools, that children are less susceptible to the virus, stands thoroughly exposed.

While the Trump administration and his state and local backers have been most aggressive, the back-to-school and back-to-work policy also has the fulsome support of the Democratic Party at every level.

With the Democratic National Convention (DNC) taking place this week, the party is fully geared towards covering up their record of facilitating the homicidal policies demanded by the ruling class. On Monday, New York Democratic Governor Andrew Cuomo absurdly claimed that his response to the pandemic was spotless, covering up the fact that nearly 33,000 people have died in the state under his watch. Cuomo has sanctioned the reopening of schools across the state, including in New York City, the largest school district in the country. Schools are also opening up in Michigan, led by Governor Gretchen Whitmer who also spoke at the Democratic National Convention Monday.

The Biden-Harris campaign website states, “Everyone wants schools to fully reopen for in-person instruction. Creating the conditions to make it happen should be a top national priority.”

The statement goes on to place the blame for the crisis solely on Trump, while proposing that schools can be reopened “safely” simply with some more funding for testing, contact tracing and PPE for educators. There are no specifics whatsoever on the level of community spread Biden thinks is “safe,” leaving the door open for districts to resume in-person learning whenever they choose, which is the exact same policy pursued by Trump.

If there is any tactical difference between Trump and the Republicans on the one side and the Democrats on school openings it is the latter’s use of the American Federation of Teachers, the National Education Association and other unions to dissipate anger through temporary delays, hybrid online/in-person learning and other maneuvers to buy time for the full reopening of the schools. Above all, the unions are doing everything they can to prevent a nationwide strike increasingly being demanded by educators because this would lead to a direct confrontation not only with Trump but Biden and the Democratic Party.

The campaign to open schools over the next few weeks in New York City and Los Angeles—both overseen by the Democrats—will set a major precedent for districts across the US. On Tuesday, Dr. Irwin Redlener, director of the Pandemic Resource and Response Initiative at Columbia University, warned of the immense dangers posed by opening schools in New York City, telling WNYC, “Schools are going to become hotbeds for the infections to take hold again and spread through the community.” He added, “It’s almost inevitable if we are in fact going to even hold some classes in real time in real classrooms,” exploding the myth that the “hybrid” model is in any way safe.

Significant outbreaks of COVID-19 have already happened in multiple Democrat-led states where at least some districts have fully reopened, including the following:

- Illinois already has at least 67 cases from 20 different schools.

- In Michigan, 16 different schools report a combined 27 confirmed cases, mostly student athletes at summer training camps.

- In California, there are at least 22 known cases from at least six schools, including 13 cases at the El Centro Elementary School District in the Central Valley.

- Pennsylvania reports at least 25 confirmed cases from 19 different schools.

- Hawaii now has at least 11 known cases at 12 different schools.

- Massachusetts has at least 17 confirmed cases at 12 different schools.

The explosion of cases at schools nationwide has provoked a huge backlash by educators, parents and students, who have already organized well over 100 protests over the past month and have assembled by the tens of thousands in dozens of Facebook groups in nearly every state.

There are growing calls for mass sickouts and nationwide strike action to halt the drive to reopen schools. In Arizona, 109 out of roughly 250 teachers and support staff in the suburban Phoenix JO Combs Unified School District called in sick Monday, canceling all classes that day. The shutdown of schools was extended through Wednesday, and teachers remain defiant and unwilling to sacrifice themselves.

Facing concerted pressure from educators and parents, the Newark Public School District in New Jersey was forced to reverse course Monday and start the school year online, after having pushed for in-person instruction for weeks. Significantly, the Newark Teachers Association had been promoting the equally unsafe “hybrid” model and, sensing huge opposition among rank-and-file educators, made an about-face on Monday.

On Wednesday in Detroit, teachers are expected to overwhelmingly support a “safety strike” in a vote organized by the Detroit Federation of Teachers, which is fearful of a revolt by the city’s 4,000 teachers.

Facing a similar groundswell of opposition, the Little Rock Education Association in Little Rock, Arkansas is now posturing as a defender of teachers’ and students’ safety. However, the union is simply demanding that in-person learning resume once the positivity rate in the county remains below 5 percent for 14 consecutive days. This elevated figure represents a high degree of community spread, and under conditions in which testing is being deliberately curtailed would be specious and wholly unsafe.

The central question facing teachers, education workers, parents and students is the need to build new forms of organization, independent of the unions, to coordinate a unified opposition to the nationwide campaign to reopen schools. It is for this reason that the Educators Rank-and-File Safety Committee was founded, in order to unite the immense opposition to the homicidal policies of the ruling class.

This national body is serving as a central organization to coordinate the building of a network of independent, rank-and-file committees in every school and neighborhood. The committees must fight to link up with broader sections of the working class facing the same deadly working conditions, in preparation for a nationwide general strike to halt the reopening of schools and the broader return-to-work campaign.