Richard Tyler

British income growth in 2017 is projected to be “hovering around, or even below, zero for the second half of the year,” according to a report by the Resolution Foundation think tank.

Following an “unprecedented squeeze on real incomes during the deep recession of 2008-09 and the years that followed,” incomes for low and middle earners had grown slightly in the last year by 2 to 3 percent, while inflation had remained “near zero,” Torsten Bell, director of the think tank, said. Although earnings had “only just returned to pre-crisis levels,” the UK was now “on course for fast, significant and repeated falls in real earnings growth early in the new year.”

Bell said this risked a return to a pay squeeze, as wages stagnated or fell and prices began to climb, while the economic reality of Britain exiting the European Union (EU) begins to bite, following June’s referendum vote to leave.

“Almost all of this drop is driven by rising inflation, as the impact of sterling’s post-referendum depreciation feeds through into higher import prices and filling up your car gets more expensive following recent oil price rises,” said Bell.

The price of basic foodstuffs is set to increase drastically over the next period, with Bell stating, “… there is a lot of uncertainty about month to month movements in both inflation and earnings figures, leaving aside uncertainty about the impact of Brexit. Supermarket competition may continue to hold down food prices, or it may not. But what there is almost total consensus on is that the direction of travel for price rises is up—and there is little sign of wage rises following suit.”

Commenting on the figures, senior research and policy analyst Laura Gardiner said the foundation’s forward-looking analysis suggested, “… an earnings growth freefall and a return to wage stagnation is just around the corner.”

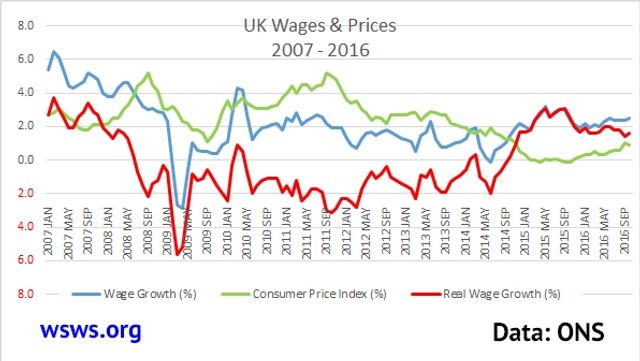

Figures from the Office for National Statistics reveal the impact of the 2008 global economic meltdown crisis—and subsequent £1 trillion bailout of the banks—on wages in the UK.

UK wages and prices 2007 to 2016

UK wages and prices 2007 to 2016

For most workers, the value of real wages began falling and failed to keep up with inflation for at least six years (see chart below) between 2008 and 2014. Despite modest pay increases from late 2014, the value of wages lost in the preceding period has still not been recouped by most workers.

In November, the Institute for Fiscal Studies (IFS) wrote that British workers faced the “worst decade for pay in 70 years.” It noted that, “average earnings fell 9 percent between 2008 and 2013 as wages failed to keep pace with inflation.” Moreover, the Office for Budget Responsibility forecast real wage growth would stall next year, and “even by 2021 average earnings will be below their 2008 level.”

According to the IFS, the “pain in the next few years” is likely to be concentrated “most heavily on low and middle-income families.” This was because continuing austerity measures being carried out by Theresa May’s Conservative government meant real terms cuts to means-tested benefits, so that “poorer households face a much sharper drop in incomes.”

The chancellor’s Autumn Statement (budget) made clear not only that there will be no let-up in austerity, the Conservatives have carried out an additional £12 billion in welfare cuts in the 18 months since the last general election, but that none of the more than £100 billion in cuts imposed by successive Labour and Tory governments since 2008 will be reversed. Chancellor Philip Hammond stressed his budget “re-states our commitment to living within our means.”

The Resolution Foundation and IFS warnings bookend the speech made earlier this month by Bank of England Governor Mark Carney who pointed out that British workers had suffered a “lost decade” in which real wage growth was the slowest since the 1860s.

With the end of 2016, workers in Britain have seen one attack after another on their pay, conditions and benefits, fueling the numbers in poverty and those who go hungry.

• One-in-three people have experienced poverty in Britain in the last three years.

• 13.5 million live in low-income households, 21 percent of the UK population.

• 3.8 million are in poverty, with the largest group being female employees.

• 55 percent of working families are in poverty—a record high.

• 3.9 million children now live in families that struggle to make ends meet—29 percent of all children—with two-thirds of poor children living in households with at least one working adult.

• 8.4 million struggle to put food on the table, over half of these regularly go a day without eating.

• When fully implemented, further benefit “reforms” will cost 2.1 million in-work families over £30 a week and 1.1 million out-of-work families at least £44 a week.

• Over 7 million people are in “precarious employment,” including self-employment, temporary work and zero-hours contracts.

• The number of self-employed reached 4.7 million, with over half on low-pay as compared to 30 percent of employees.

• 460,000 are falsely classified as “self-employed”—costing as much as £314 million a year in lost tax and employers National Insurance Contributions.

No comments:

Post a Comment