Gabriel Black

In the 10-plus weeks since President Donald Trump signed into law his $1.5 trillion tax cut for corporations and the rich, US companies have funneled the vast bulk of their windfalls into stock buybacks rather than using it, as promised by the White House, to invest in production, jobs and higher wages for workers.

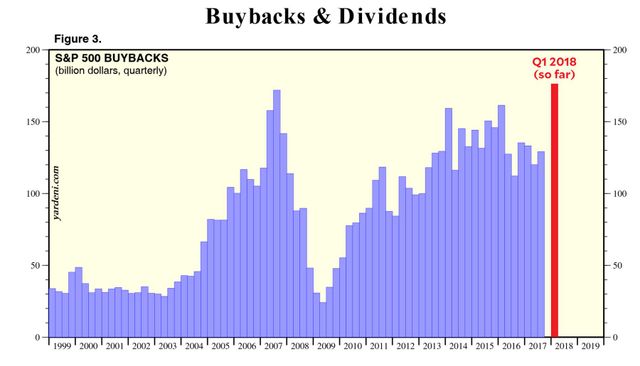

By mid-February, $171 billion in stock buybacks had been announced—more than double the $76 billion announced in the same period of 2016-2017, according to the stock market research firm Birinyi Associates. This is the largest amount ever recorded at this point in a new year.

Catalyst Capital, a market research firm, predicts that 2018 will be the biggest buyback year on record, with corporations spending $1.2 trillion to push up their share values and reward their major shareholders, far surpassing previous years.

Compared to these huge sums, the amount being spent by corporations in “tax reform” bonuses for their workers is a pittance. Of the 500 companies in the S&P 500, 44 have announced bonuses or raises because of the new tax law. The total new money these 44 companies plan to spend on workers this year is just $5.2 billion, according to research by Rick Wartzman, William Lazonick and the Academic-Industry Research Network published by the Washington Post in February.

Certain companies, like Bank of America, are providing one-time bonuses “in the spirit of shared success.” Bank of America’s $1,000 bonus will cost the company $145 million. Meanwhile, it will spend at least $17 billion for stock buybacks in just the first half of this year. For every dollar spent by the bank on its 145,000 employees, it is spending $117 on enriching its owners, including its top executives.

Speaking to the Financial Times, the CEO of Bank of America, Brian Moynihan, declared quite openly, “We expect most of the benefits from tax reform to flow to the bottom line through dividends and share buybacks.”

As the World Socialist Website stated last year, Trump’s tax cut “is designed to massively transfer wealth from the working class to the ruling elite.” The tax cuts will be used as the pretext to bleed dry key programs such as Medicare, Medicaid, food stamps and Social Security.

The claim, promoted by the Trump administration, that the tax cut would lead to a boom in domestic investment and wage growth was a lie to begin with. Less than three months in, the numbers only make this clearer.

Shareholder buybacks were once rare occurrences, frowned upon as a form of market manipulation. They divert profits away from investment in new production, research and development, and capital improvement and use it for the entirely parasitic purpose of lining the pockets of the financial aristocracy.

It was only in 1982 that the US Securities and Exchange Commission provided a legal mechanism for buybacks. Since then, in step with the general financialization of the economy and explosion in stock prices, buybacks have grown in size, for the first time surpassing dividend payments in 1998, under the Democratic Clinton administration.

Buybacks are an expression not of the health of the economy, but its sickness. It is a signal that those who own the major companies believe that reinvestment in the economy will yield a smaller return than just pocketing the profits extracted from their workforce for themselves.

Consider the exponential increase in buybacks that occurred prior to the last financial crisis. In 2004, buybacks hovered around $120 billion a year. However, in the ensuing years they exploded, alongside the financial bubble—reaching over $500 billion in 2007 before crashing during the 2008 financial crisis.

Today, Wall Street demands more. The mood on “the street” is that those firms that do not funnel the money back to investors should be punished.

“Shareholders are going to be banging on doors saying we want some of that money,” Howard Silverblatt, analyst at S&P Dow Jones, told the Financial Times. As the Financial Times explained, “No matter that stock markets have set record highs of late, the expectation that spare cash must be returned to its rightful owners is putting managers under pressure.”

Speaking to the New York Times, Silverblatt explained, “I’m expecting buybacks to get to a record for 2018. And if I’m disappointed, there’s a lot of people with me.”

The reality is that the billionaires who will benefit from this vast squandering of money are not the rightful owners of this wealth. The massive sums, including trillions in off-shore money being repatriated under Trump’s tax plan, is the product of the labor of workers.

Although the Democratic Party has postured as an opponent of Trump’s tax plan, in truth the so-called liberal establishment, which benefits immensely from the surge in stock values, agreed with core aspects of Trump’s plan. In November, the New York Times published an editorial declaring support for corporate tax cuts. The Times wrote, “If Republicans worked with Democrats, they could reach a compromise to lower the top corporate tax rate.”

The top 10 percent of the population owns 84 percent of all stocks in the United States. Three men—Jeff Bezos, Bill Gates and Warren Buffet—have a combined wealth equal to that of the bottom half of the American population. The recently published 2018 World Inequality Report found that while the income share of the top 1 percent of US earners rose from 10 percent in 1980 to 20 percent in 2016, the share of the bottom 50 percent fell from 20 percent to 13 percent over the same period.

As 2018 unfolds, this gross inequality will only increase, allowing Wall Street to pocket over a trillion dollars while workers’ living standards continue to dive. Meanwhile, the grounds have been laid for a new economic crisis that will be larger than the last.

No comments:

Post a Comment