Shannon Jones

Last week workers filed more than 1.5 million new US jobless claims as job-cutting continues in the midst of the still raging coronavirus pandemic. Through the week ending May 30, 20.9 million workers were drawing unemployment benefits, down only slightly from April.

The new claims push the total number of those filing for unemployment benefits over the last 12 weeks to 44.1 million. It is now being predicted that weekly claims will not drop below 1 million until July. Before the pandemic, the previous record for weekly claims was 695,000 in October 1982. While new claims fell in a number of states, they rose sharply in California, (29,000) Massachusetts (17,000) and Maryland (9,000)

An additional 706,000 people filed initial claims under Pandemic Unemployment Assistance, a separate program that expands eligibility to the self-employed and independent contractors, among others. About 10 million workers are currently receiving financial aid through the program.

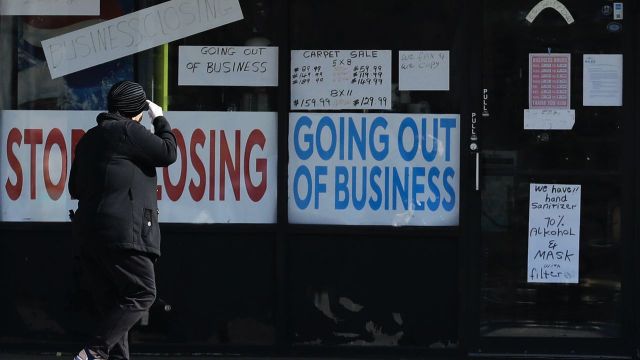

A woman looks at signs at a store in Niles, Ill., Wednesday, May 13, 2020. (AP Photo/Nam Y. Huh)

A woman looks at signs at a store in Niles, Ill., Wednesday, May 13, 2020. (AP Photo/Nam Y. Huh)

The latest weekly figures come as serious concerns persist over the validity of figures showing a drop in the unemployment rate in May to 13.3 percent from 14.7 percent in April. The fall in the unemployment rate contradicted the expectations of economists.

The Bureau of Labor Statistics (BLS) admitted that its May and April figures seriously understated the true rate of unemployment, by 3 percent in May and a whopping 5 percent in April. The BLS said the problem was due to a data collection “error.”

Questions have also been raised over the striking discrepancy between the BLS figure of 20.9 million unemployed and the weekly jobless claims report, which shows that a total of 30 million are claiming continuing unemployment benefits in all programs.

The persistent high level of new unemployment claims demonstrates that even as workers laid off due to the pandemic are being recalled, the economy continues to bleed jobs, as companies stagger under the continuing impact of the COVID-19 crisis.

The public sector has been particularly hard hit as tax revenues dry up. State and local governments cut 571,000 jobs in May after cutting 1 million jobs in April. One expert predicted that state and local governments would cut 3 million jobs as a consequence of budget shortfalls. Education will be hardest hit, both K-12 and higher education.

Alaska Air said it plans 3,000 job cuts after it burns through the $992 million in federal bailout money that requires it to maintain jobs through the end of September. The airline said job cuts will likely begin in October. According to Fortune Magazine, global airlines have announced 70,000 job cuts, and more will take place in the US in the fall.

Meanwhile, many of those filing for unemployment benefits are still waiting for payment on their claims. A survey by ZipRecruiter found that one-third of claimants who lost their jobs due to the pandemic are still waiting for their money. The survey was done between June 1 and June 4.

The idea floated by President Donald Trump that the recession triggered by the pandemic would be V- shaped, with a quick recovery, is being increasingly discredited. US economic output is predicted to fall by 6.5 percent through the end of 2020.

On Wednesday, Federal Reserve Chairman Jerome Powell played down the idea that a full recovery is in the offing. “I think we have to be honest, that it’s a long road,” he said, pointing to the serious impact the pandemic is having on wide sectors of industry. “It could be some years before we get back to those people finding jobs.”

The Federal Reserve is now predicting that unemployment will still be at 9.3 percent by the end of 2020, near the high recorded in the 2008-2009 recession. Powell noted, “This is the biggest economic shock, in the US and the world, really, in living memory.”

He said that many job cuts will be permanent. “My assumption is that there will be a significant chunk, well into the millions,” He added there will be many “who don’t get to go back to their old job, and, in fact, there may not be a job in that industry for them for some time.”

Wells Fargo noted the continued high level of unemployment claims indicates “that layoffs have clearly spread well beyond” the industries directly impacted by the pandemic and state lockdowns. It pointed to cuts in manufacturing, administration and professional service companies.

The Bureau of Labor Statistics reported that the economy added 2.5 million jobs in May after losing 22 million jobs in March and April. The additional hiring mainly reflected workers being recalled to their previous jobs after being laid off due to the pandemic.

Meanwhile, the BLS is continuing to fend off suspicions that it has played fast and loose with the unemployment figures.

According to a note appended at the bottom of its May report, the BLS said unemployment numbers reported in May represented a 3 percent undercount due to errors in data collection, making the actual unemployment rate 16.3 percent. A similar “error” in April undercounted the total unemployed by 5 percent, making the real total a shocking 19.7 percent. The “error,” if that is what it was, is by far the largest in the history of the BLS.

The unemployment numbers are collated from tens of thousands of interviews by data collectors. The BLS says interviewers wrongly classified some unemployed workers as employed but “absent from work" due to “other reasons,” when they really should have been listed as temporarily laid off due to pandemic-related workplace shutdowns. This misclassification affected nearly a million workers in May.

Questions remain over why if, as the BLS states, the collection error came to its attention in March, it persisted through May.

In addition, economists were struggling to explain the discrepancy between the 21 million reported as unemployed by the BLS and the 30 million that continue to collect jobless benefits. They pointed to several factors, including the above-cited data collection error as well as the possibility that some of the 10.3 million “gig economy” workers collecting benefits under the temporary expansion of unemployment benefits were not counted in the unemployed totals.

Economists also pointed to the low response rate in May as an area of concern when evaluating the accuracy of the numbers. Only 67 percent of households responded to the survey in May, which is significantly lower than the typical 80 percent response rate before the pandemic. Fewer people being sampled means that the figures are based overall on a less representative sample of the population.

Adding to suspicions, an independent report by human resource provider ADS showed that the economy lost 2.76 million jobs in May instead of adding 2.5 million, as stated by the BLS.

BLS Commissioner William Beach, appointed by Trump to head the agency in 2019, denied allegations the data had been fudged and said that such allegations stem from an “enormous ignorance” of how the BLS operates.

Whatever the truth about possible tampering—and there is every reason for suspicion—the relatively favorable unemployment numbers gave a boost to the Trump administration, which was reeling from crisis in the midst of mass protests over police violence and continuing opposition by workers to the premature reopening of the economy even as COVID-19 infections were on the rise in many areas. The positive employment report for May also helped boost stock prices, which soared on the news.

The figures were also cited by Republican members of Congress as an argument for not extending the $600 weekly supplement to unemployment benefits enacted in April as a result of the pandemic.

While winding down assistance to the unemployed, the Trump administration, Congress and the Federal Reserve have committed to taking all necessary measures to prop up the stock market, pledging unlimited amounts of cash and zero interest rates.

No comments:

Post a Comment