Barry Grey

Increasing volatility on US and world stock markets erupted Friday in a steep decline in stock prices, led by a 665-point drop in the Dow Jones Industrial Average. The 2.54 percent fall in the Dow, the biggest single-day decline since June 2016, was accompanied by similar drops in the other US stock indexes and a broad sell-off on European markets, topped by a 1.68 percent decline in the German DAX index.

With Friday’s plunge, the major US indexes posted their worst weekly performance in two years. The financial press tied the stock sell-off to rising interest rates on US government bonds and the jobs report for January, released on Friday, which showed a 0.9 percent year-on-year increase in average wages, the biggest rise since 2009.

It remains to be seen whether Friday’s sell-off is the beginning of the implosion of asset bubbles about which a growing chorus of economists has warned. But whatever the immediate fate of the markets, there are many indications that the increased volatility marks an inflection point in the world economic and political crisis of capitalism.

It takes place amidst a confluence of factors, at the center of which are clear signs of a resurgence of working class struggle on an international scale. The American ruling class reacted with alarm to the modest increase in wages in January because it is seen connected to a growth of working class militancy and a determination to win back what has been taken away in wages, jobs and living standards over the past four decades.

The US jobs report came in the midst of a resurgence of working class resistance across Europe. Hundreds of thousands of German industrial workers are striking to reverse decades of austerity and mounting social inequality in the biggest labor action in that country in 15 years.

The militant mood of the workers is making it more difficult for the trade union leaders to impose a sellout. Moreover, the strike is threatening to undercut negotiations between the union-backed Social Democrats and the conservative parties aimed at installing the most right-wing, militaristic government since the fall of Hitler’s Third Reich.

The German strikes follow mass protests in Greece against the Syriza government, strikes by autoworkers in Eastern Europe, rail strikes in Britain and mass working class protests in Iran and Tunisia.

The uptick in US wages is a major factor driving a sudden and rapid increase in interest rates, which threatens to undercut the entire basis of the stock market boom and obscene enrichment of the corporate-financial elite, particularly since the Wall Street crash of 2008. The yield on the benchmark 10-year US Treasury bond rose to 2.85 percent, the highest point in four years. Government bond rates are also rising in Europe.

The New York Times wrote, “The immediate catalyst [of the fall] was the jobs report, which showed the strong United States economy might finally be translating into rising wages for American workers—a sign that higher inflation could be around the corner.”

Financial Times columnist John Authers commented: “The shark is growing more visible. For years now, the possibility of a sharp upward shift in bond yields, and a return to inflation psychology, has been by far the most menacing risk for markets. As in Stephen Spielberg’s classic Jaws, the menace is always there, under the surface, but largely only hinted at and unseen. When the behemoth finally comes into view, it is terrifying…”

Other factors driving the crisis in the markets include:

* Mounting geo-political and economic tensions, with a looming threat of war and trade war, driven by the Trump administration’s “America First” agenda of economic nationalism and militarism.

* Political instability within the US, Germany, the UK, France and other major powers. The American ruling elite is locked in internal political warfare, which threatens to bring down the Trump administration; Germany has yet to form a new government nearly five months after its national election; Britain’s ruling elite and its major parties are hopelessly divided over Brexit, and the country is headed by a government seen to be a lame duck.

* A massive overhang of government and corporate debt. An end to low rates threatens to plunge corporations and entire countries that have relied on the availability of limitless and cheap credit into bankruptcy.

Since 2009, the US government and the Federal Reserve have effectively guaranteed an unlimited supply of virtually free money to the banks, hedge funds and big investors. They have done so by keeping interest rates at super-low levels and pumping cash into the financial markets by means of the money-printing operation dubbed “quantitative easing.” With the major imperialist governments and central banks in Europe and Asia following the US lead, trillions of dollars of worthless assets have been shifted from the balance sheets of the banks to the state ledgers.

This vast operation to rescue the global financial oligarchy from the consequences of its own criminal actions and ensure its further enrichment has been carried out on the backs of the working class. Austerity, wage-cutting and speedup have been used to drive down the living standards and social conditions of the masses. In the US, this has been the policy of Democratic no less than Republican administrations.

The past ten years have seen an intensification of a social counterrevolution underway for decades. The intensity and effectiveness of this ruling class offensive has been reflected in the steady rise in stock prices since the Reagan administration.

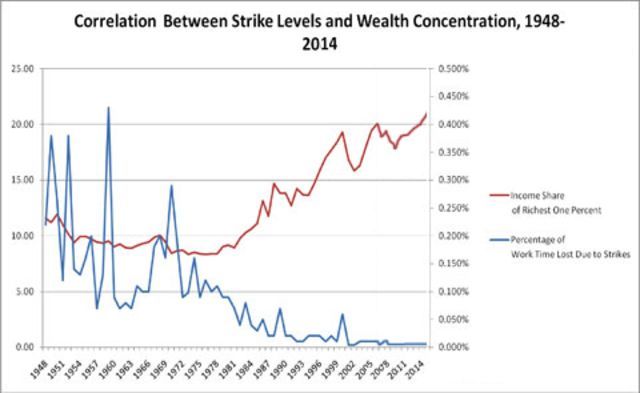

Correlation between strike levels and wealth concentration: 1948-2014

Correlation between strike levels and wealth concentration: 1948-2014

This process depended on the suppression of the class struggle. The ruling class relied on the trade unions to undermine working class opposition, block strikes, and isolate and betray them when they broke out. The fever chart of rising stock prices, accordingly, is in inverse proportion to the decline and virtual disappearance of strikes in the United States over this period.

But the ability of the ruling class to count on the unions to police the workers is breaking down. In the United States, the United Auto Workers union is completely exposed and discredited by a corruption scandal involving company bribes to union officials in return for the imposition of concessions contracts on the workers.

As the World Socialist Web Site stressed at the beginning of the year, 2018 will be marked above all by a rise in social tensions and a revival of working class struggle on an international scale.

The long historical cycle dominated by the artificial suppression of the class struggle is coming to an end. A new period, which will see a counteroffensive by the working class to win back all that it has lost and more, has opened up.

No comments:

Post a Comment