Kate Randall

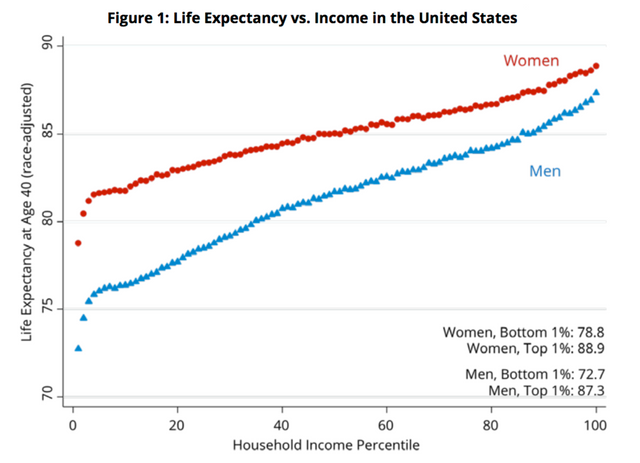

Rising income inequality in the United States means that wealthy Americans can now expect to live up to 15 years longer than their poorest counterparts, the Lancet finds in a new series, “America, all things not being equal.” The research follows a report from the Centers for Disease Control and Prevention (CDC) in December showing that overall life expectancy in the US fell between 2014 and 2015 for the first time since 1993.

In the first part of the Lancet series, “Inequality and the health-care system in the USA,” the British medical journal’s researchers found that these income-based disparities in US life expectancy are worsened by the for-profit US health care system itself, which relies on private insurers, pharmaceutical companies and health care chains. It is also the most expensive health system in the world.

The life expectancy gap between rich and poor has been widening since the 1970s. Since this time, the share of total income going to the top 1 percent has more than doubled, while the vast majority of workers have seen their incomes stagnate or decline in real terms.

Today women in the top 1 percent of income can expect to live 10.1 years longer than the bottom 1 percent of women earners; men in the top 1 percent can expect to live 14.6 years longer than the bottom 1 percent.

This dramatic contrast in life expectancy between the rich and poor is directly correlated to the growth of obscene wealth at the top among a tiny elite and entrenched poverty among growing numbers of people at the bottom. Since 1986, the top 0.1 percent—those with assets exceeding $20 million—has accumulated nearly half of all new wealth.

By comparison, more than 1.6 million US households, including 3.5 million children, struggle to survive on less than $2 per person per day, the World Health Organization’s definition of extreme poverty.

Health care costs

It is a cruel irony that the US health care system is one of the main drivers of poor health and low life expectancy, particularly burdening low-income households with rising costs. Many patients are unable to pay for the medical care they need, with some forgoing care altogether.

In 2014, after full implementation of the Affordable Care Act (ACA), 19 percent of non-elderly adults who received prescriptions could not afford to fill them. The Lancet research shows that health care costs—including insurance premiums, taxes and out-of-pocket payments—are forcing millions of Americans to cut back on food, heat, housing and other basic necessities.

Millions of middle class families have been driven to bankruptcy by illness and medical bills. Medical bills comprise more than half of all unpaid personal debts sent to collection agencies. Meanwhile, the super-rich are turning to “concierge practices” where they pay out of pocket to gain access to a wide-range of high-priced medical specialists.

Disparities in access to health care can be largely attributed to insurance status. Despite an increase in those insured under the ACA, largely due to the expansion of Medicaid (the insurance program jointly administered by the federal government and the states), 27 million Americans remain uninsured. These include people in those states that opted out of the Medicaid expansion, as well as an estimated 5-6 million undocumented immigrants who are excluded from coverage under what is popularly known as Obamacare.

The uninsured are far more likely to go without needed doctor visits, tests, treatments and medications due to cost. This is especially true for those with chronic conditions. The Lancet gives the example of uninsured individuals with diabetes, who spend on average $1,446 out of pocket on medical expenses each year.

Among patients who develop an acute myocardial infarction (heart attack), those who are uninsured are 38 percent more likely than the insured with low out-of-pocket costs to delay emergency care. Poor Americans under the age of 50 are also far less likely to receive recommended flu and pneumonia vaccinations and cancer screening tests than their wealthy counterparts.

In the private insurance market, which includes Obamacare plans, patient cost-sharing—including co-pays and deductibles—has increased substantially since the 2000s. ACA plans have some of the highest deductibles, averaging $3,064 for “silver” plans in 2016. More than 80 percent of employer-based plans now include an annual deductible, averaging $1,478 in 2016, 2.5 times more than the 2006 average.

When cost-sharing forces patients to forgo care, in some cases doctors and hospitals fill their empty appointment slots and beds with patients who are less “price sensitive,” i.e., able to pay more out of pocket.

“Underinsurance” and access to care

The researchers refer to the growing phenomenon of “underinsurance,” writing: “Rising deductibles and other forms of cost sharing by patients have eroded the traditional definition of insurance: protection from the financial harms of illness.” In other words, while many people technically have insurance coverage, they often cannot afford to use it due to skyrocketing premiums and high out-of-pocket costs.

Geography is often an indicator of access to care, with those living in rural areas finding it difficult to obtain primary and specialty care. Many rural and Southern states also have a shortage of family planning resources. Women in Lubbock, Texas, for example, now live more than 250 miles away from the nearest abortion clinic, a result of reactionary anti-abortion restrictions imposed by the state.

Women overall are at a disadvantage in obtaining and paying for medical care compared to men, due to greater health care needs, including reproductive care. Although fewer women are uninsured, those who are insured have higher out-of-pocket costs, with these costs averaging $233 higher than men’s in 2013. While their costs are higher, women’s median incomes are 39 percent lower than men’s.

A Princeton University study presented last month showed a sharp rise in the mortality rate for white, middle-aged working class Americans driven by “deaths of despair,” those due to drug overdoses, complications from alcohol abuse and suicide. The Lancet research shows, however, that despite this crisis access to care for mental illness and substance abuse is woefully inadequate and underfunded.

Psychiatric providers, for substance abuse in particular, are in short supply on a national scale, especially in poor and rural areas. America’s bloated prison system, incarcerating more than 2.4 million in its prisons and jails nationwide, remains the largest “inpatient mental health” facilities in the US. “Treatments” afforded mentally ill patients often include segregation and solitary confinement.

Paradoxically, the US medical system, as the employer of nearly 17 million Americans, exacerbates health care inequality. While physicians and many nurses are generally well paid, many other health care workers are not. The health care system employs more than 20 percent of all black female workers, and more than a quarter of these women subsist on family incomes below 150 percent of the federal poverty line; 12.9 percent of them are uninsured.

While decreasing the official uninsured rate, mainly through the expansion of Medicaid, Obamacare has in fact exacerbated the US health care crisis. In 2017, millions of working and middle class Americans face higher premiums and out-of-pocket costs, less access to vital medical treatments and care, and resulting poorer health outcomes and lowered life expectancy.

This is by design. Based as it is on the profit system, the ACA was deliberately crafted to boost the profits of the private insurers while cutting costs for the government and large corporations. Employers, both public and private, have taken their cue from Obamacare, reducing coverage, raising premiums and costs, and eliminating coverage outright in some cases.

Any “replace and repeal” of Obamacare by Trump and the Republicans would only accelerate this process, in particular through gutting Medicaid through block-granting or other means, tossing tens of millions more into the ranks of the uninsured, and rationing medical services while further driving up costs.