Kevin Reed

As further details emerge about the server breach at Equifax—one of the largest and most damaging theft of sensitive personal data in history—the magnitude and long-term implications of the credit reporting agency’s negligence are becoming clearer. The failure of Equifax to take the most basic security measures to protect the credit information of 143 million customers has rightfully provoked an angry response from people all around the world.

According to a company press release on September 7, hackers exploited a “website application vulnerability” at Equifax and gained access to huge volumes of consumer data—including Social Security numbers, birth dates, addresses and credit card account details—over a two-and-a-half-month period in the late spring and early summer of this year.

When the breach was discovered on July 29, company executives did nothing to alert anyone that their credit standing was in serious jeopardy. Instead, three top executives moved to sell $1.8 million of their company stock while they waited another six weeks to report the hack to the public.

Along with the press release, the CEO of Equifax Rick Smith appeared visibly shaken in a YouTube video where he promised to provide identity theft protection and credit file monitoring services at no charge to “every US consumer.” While he claimed that a preliminary investigation showed “no unauthorized activity on our core credit reporting databases,” he said that a dedicated web site and call center had been set up to “help consumers manage their personal situation.”

It quickly became clear that Equifax had no intention of responding to the flood of inquiries that came in, as phone calls went unanswered and the special web site ground to a halt. Meanwhile, it was revealed that the terms of service agreement for the free package contained provisions that prevented individuals from ever seeking injunctive relief from Equifax if damage to their credit caused financial harm.

Equifax has now reported that the server vulnerability was well known to the Apache developer community, and a patch had been developed for it months before the massive breach. In other words, Equifax never installed critical security updates on its public web site that had been available since March of this year. A company that is supposedly tasked with determining the financial responsibility of millions of people acted out of gross negligence.

Beyond the circumstances of the hack, the events of the past several weeks raise a broader question: What is Equifax, and why does it have the personal data of half of the American population?

Equifax—along with TransUnion and Experian—is a credit reporting agency (CRA) that collects information on the borrowing and repayment activity of private individuals. These companies do not receive permission from individuals to gather this data. They buy it from other companies, collect and package it, and sell to other companies.

The data on individuals maintained by the CRAs is held in a consumer credit report, which can include how often on-time payments are made, how much credit is available, how much credit is being used, and whether a credit account is in “collections” due to late or missed payments. The report can also contain public records such as liens, judgments, and bankruptcies that provide details about an individual’s financial status.

The report is distilled into a “credit score” that has enormous implications for individuals. This mystical number can determine whether you can get a credit card, a home mortgage, an apartment rental, an auto loan or even a job. It also is used to determine the interest rate on any loans you do get. An individual with a bad “credit score” can be forced to seek credit from loan sharks charging astronomical interest rates.

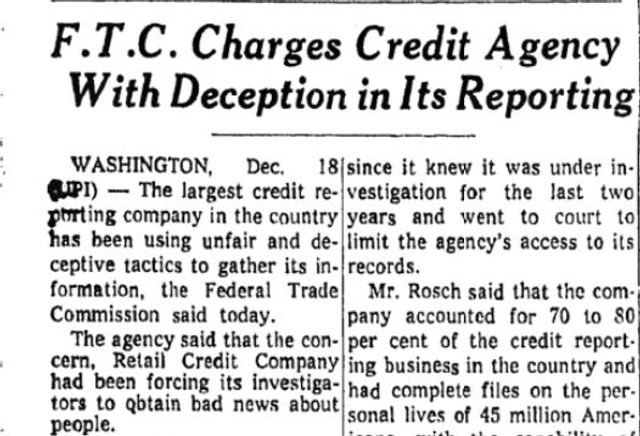

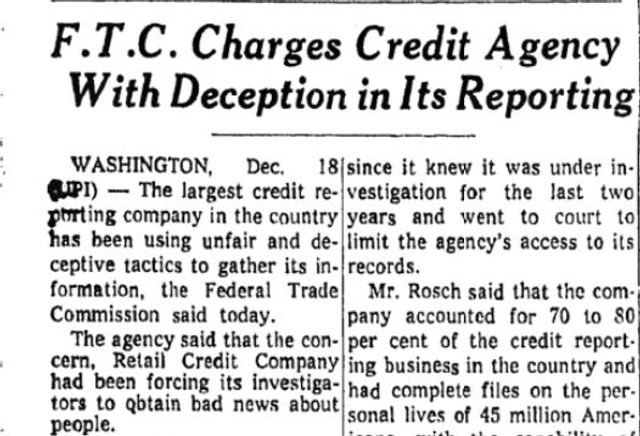

Equifax is the oldest of the three main CRAs. Founded in 1899 as Retail Credit Company, Equifax grew rapidly throughout the 20th century as a primary source of information for companies seeking to lend money or sell insurance to individuals. By 1960, it had grown into one of the largest CRAs. It pioneered the intrusive practice of maintaining millions of “files” on American and Canadian citizens about their personal health, habits, morals, use of vehicles, and finances. Employees of Retail Credit Company were rewarded for gathering negative information regardless of the basis in facts.

A clip from the New York Times, December 19, 1973, on the Retail Credit Company, predecessor of Equifax

A clip from the New York Times, December 19, 1973, on the Retail Credit Company, predecessor of Equifax

As credit information went from paper to electronic form, the practices of the precursor to Equifax—including gathering information on an individual’s marital troubles, sex life, and political activities—began to come under public scrutiny. In the socially and politically explosive period of the late 1960s and early 1970s, the US Congress held hearings and passed the Fair Credit Reporting Act (FCRA), which restricted the activities of CRAs and granted consumers legal rights to the information contained in corporate databases.

As the reforms of the FCRA were enforced through an increasingly toothless system of slap-on-the-wrist fines, Retail Credit Company changed its name to Equifax in an attempt to distance itself from its past. However, the undemocratic and oppressive practices of the credit reporting industry continued and intensified with the expansion of computerization in business record keeping, data sharing, and the development of the Internet.

In the 1980s, the consumer credit scoring system devised by engineer William Fair and mathematician Earl Isaac was adopted as the standard for evaluating a consumer’s ability to repay loans. In 1989, the FICO score (for “Fair Isaac Corporation”), with the range of 350 (high risk) to 800 (low risk), was introduced. Since then, the FICO scores provided by CRAs for every individual have become the primary reference point for mortgages, auto loans, credit cards, and other forms of credit.

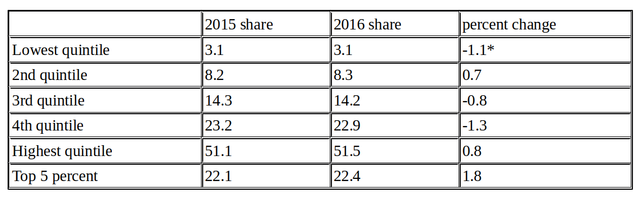

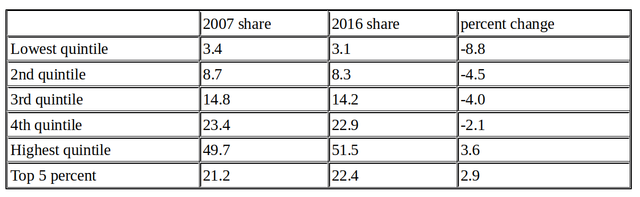

The development of the credit ratings agencies has correspondence to the financialization of the economy—the dominance of parasitic financial services over other forms of economic activity such as manufacturing. This same period has seen a steep growth in consumer debt. As the gap between the super-rich and the working class skyrocketed, tens of millions of working people were forced to rely upon various forms of credit to sustain living standards or just make it from day to day.

According to the Federal Reserve, American household debt as a percent of GDP was less than 20 percent in the years after World War II, and less than 50 percent in 1980. As the ruling class escalated the offensive against jobs and wages under Reagan and the administrations that followed, debt skyrocketed, to 97 percent by 2008. Even after the economic collapse of 2008, precipitated by the predatory lending practices of the financial industry, consumer debt stands at 80 percent of GDP today. Enormous profits have been generated for the lenders and their financial investors over this span of time.

Household Debt as a Percentage of GDP

Household Debt as a Percentage of GDP

Throughout this process, the credit reporting agencies like Equifax have played a crucial role as instruments of the big banks and investment firms to ensure that debts are collected and maximum interest rates are charged. Meanwhile, those who face the brunt of the economic crisis—the loss of a job, a wage cut, rising costs of health care, etc.— are doubly punished by credit reporting agencies, as they drop FICO scores just when workers are most in need of financial assistance.

There are, moreover, approximately 50 million people in the US who are so-called “credit invisibles,” with no credit records or with credit histories that are “unscorable.” This means that 10 percent of the eligible population does not exist for the consumer credit industry due to poverty or extremely low incomes. Lack of access to credit means these layers of the population are subject to the predatory lending of the payday loan industry and other forms of semi-legal or illegal lending.

The implications of the Equifax hack—as well as the outrageous behavior of company executives—are so damaging that both houses of Congress and several state governments have launched official probes. On Wednesday, the US House Financial Services Committee announced that Equifax CEO Richard Smith will testify on October 3 before a panel and be questioned about the breach and his company’s response to it.

Recognizing the growing hostility of millions toward the credit reporting industry, all manner of populist posturing has been mounted by Democrats and Republicans. For example, speaking about the $1.8 million sale of Equifax stock by three top company executives after the data theft was discovered, Senator Heidi Heitkamp of North Dakota—a prominent Democratic backer of Trump’s proposed corporate tax cuts—told Reuters, “If that happened, somebody needs to go to jail.”

Nothing of significance will come of the official proceedings in Washington, DC and the state houses in Rhode Island, Connecticut, Pennsylvania or Illinois over the Equifax debacle. This is because any penetrating examination of the big business of credit reporting, FICO scores and “identity protection” services will expose the truth of class relations under capitalism, i.e., the dictatorship of the financial elite over the whole of society.

The negligent practices of Equifax with the personal credit data of millions is one more indication of the real relationship between the oligarchy at the top of society and the rest of the population.

In the aftermath of Equifax data fiasco, it is entirely possible for workers to conceive of circumstances where there is no need for human beings to be identified as a three-digit FICO score, where there is no parasitic elite that rules over the whole of society, where everyone has the right to a decent, high-paying job, and is not subject to the whims of the credit reporting agencies and the financial institutions they serve.

This, however, will require the abolition of the entire financial industry, its transfer to public ownership based on workers’ control, and a massive redistribution of wealth from the financial elite to the working class that produces all the wealth of society. It will require, in short, a political movement of the working class to abolish the capitalist for-profit system and establish socialism.